NEXTENERGY FOUNDATION ENDOWMENT FUND

NextEnergy Foundation (“NEF”) launched an endowment fund in March 2023. The endowment strategy operates in five-year cycles and the income generated will supplement the Foundation’s grant-making activities. The Trustees of the NextEnergy Foundation have appointed an investment manager, EQ Investors, to manage the fund.

The fund’s investments fully align with NEF’s mission – to participate proactively in the global effort to reduce carbon emissions, provide clean power sources in regions where they are not yet available, and contribute to poverty alleviation – and 100% adhere to ‘do-no-harm’ principles. Please refer to the Investment Policy Statement for more details about the investment strategy.

Our Positive Impacts

Investments

EQ Investors (“EQ”) invests in funds that select companies and projects whose core products and services provide solutions to address global sustainability challenges. EQ uses the UN Sustainable Development Goals to select these solutions, and to avoid investments that prevent progress on the goals. For example, this includes investment themes:

- Health and well-being

- Social inclusion & empowerment

- Climate

- Natural capital and biodiversity protection

Positive impacts associated with the investments held in NEF’s portfolio as at 31st December 2025 include:

Disclaimer: All data and analysis provided by EQ Investors. Portfolio weightings as at 31 December 2025. Investing (e.g. buying shares in a company) does not create these outputs and outcomes: they are generated by the activities of our underlying portfolio holdings. An investment can be associated with these measures based on company disclosures and share of ownership. Household equivalents calculated using average UK household consumptions and emissions.

The impact made is associated with the amount invested. For an in-depth explanation see: https://eqinvestors.co.uk/wp-content/uploads/2022/10/Methodology-case-study-2022.pdf

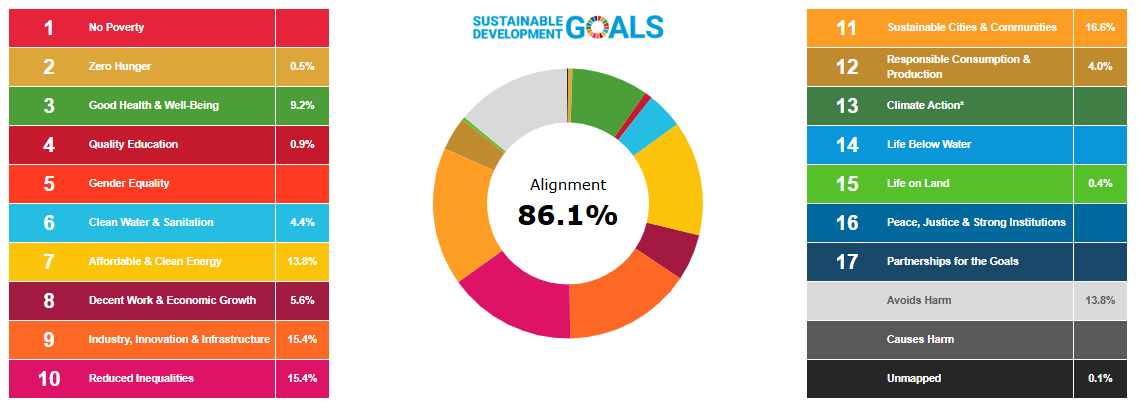

In addition, 86.0% of NEF’s portfolio contributes solutions aligned to the SDGs. The fund’s investments fully align with NEF’s mission and adhere 100% to ‘do-no-harm’ principles.

Disclaimer: All data and analysis provided by EQ Investors. Portfolio weightings and underlying holdings are shown as of 31 December 2025. To produce this data, we use a snapshot of the funds held at the last rebalance. Underlying fund holdings are updated on a quarterly basis. This data draws on EQ Investors’ own proprietary database based of companies and projects mapped against the EQ UN Sustainable Development Goal’s methodology. Companies and their bonds, as well as infrastructure assets, are assessed for their core revenue alignment to positive and negative criteria.

Percentages may not add up to 100% as they are rounded to the nearest decimal. Global Goals with no figure indicate the portfolio has 0% exposure; this is because either the Global Goal presents few investable opportunities, or companies within the portfolio provide exposure to multiple goals and the most relevant goal has been selected. *The Climate Action goal overlaps with more specific goals, so we have instead mapped our exposure to these.

INVESTMENT CASE STUDY: GILEAD

Activities: Gilead is a leading biopharma company, providing innovative therapies for the treatment of HIV, cancer, inflammation and liver disease. Patient reach is also supported through the forming of partnerships as a means to deconstruct barriers to care and health inequities.

Output: Gilead’s track record includes the development of 13 HIV antivirals approved across a 23-year period. In 2024 alone, Gilead managed to make 14.8 million units of HBV and HIV treatment available. Equally, Gilead boasts a leading position in the Cell Therapy industry, providing more than 25,000 cancer patients with Kite CAR T-cell therapy across over 40 countries.

Outcome: As a result of the significant progress within the space of HIV treatment and prevention, which Gilead contributed to, HIV rates in 2023 were lower than any year from the late 1980s onwards and have even decreased by 39% since 2010. Gilead are now in the process of seeking approval for a groundbreaking drug in the space, lenacapavir, which could prove be crucial towards global HIV prevention.

Impact: By 2030, end the epidemics of AIDS, tuberculosis, malaria and neglected tropical diseases and combat hepatitis, water-borne diseases and other communicable diseases.

STEWARDSHIP AND ENGAGEMENT

EQ also actively engages for change towards a more sustainable world. EQ tracks the impact that its investment strategy makes through a multi-layered stewardship framework which comprises the following:

- Assessment and Monitoring of external fund managers’ own engagement and voting policies, processes, and records.

- Engagement with external fund managers on identified weaknesses, and strategic engagement themes, with an aim to affect ESG/sustainability and stewardship ambition.

- Collective, collaborative engagement on underlying holdings to elevate concerns on strategic engagement themes.

- Annual General Meeting (AGM) attendance and board questioning on sustainability strategy of selected underlying holdings.

For more details about EQ’s approach to engagement, please refer to its https://eqinvestors.co.uk/eq-stewardship-and-engagement/

Engagement Case Study: Engagement on access to medicine

While treating people for disease or offering preventative healthcare is inherently positive, companies’ additional impacts can be further enhanced. While the selected portfolio companies will broadly adhere to responsible marketing and pricing strategies, we see great opportunity to engage on embracing leading practices that address unmet needs more effectively.

The Access to Medicine Foundation is a philanthropically funded organisation that aims to use research and related shareholder engagement to guide the pharmaceutical industry to do more for people in low- and middle-income countries.

The foundation published its Access to Medicine Index 2024, which ranks healthcare companies based on the governance and reach of their strategies to bring their treatments to low- and middle-income countries.

EQ’s engagement activity

This year we engaged with 7 fund managers relevant to NEF’s portfolio, on their approach to health access, aiming to move them all to best practice and building on the work of the Access to Medicine foundation.

EQ has joined the Access to Medicine Initiative’s SDG 3 collaboration to engage with companies on these best practices and continue to accelerate positive change.